Best Technical Indicators for Trading: A Complete Guide to Trend, Momentum, and Volume Analysis

Key Takeaways

-

Technical indicators help predict market trends.

-

Trend indicators reveal market direction and momentum.

-

Momentum indicators measure price strength.

-

Volume indicators confirm market trends.

-

Different trading styles require different indicators.

-

Avoid common mistakes with proper indicator usage.

-

Combine indicators for stronger trading signals.

-

Learn from case studies and real examples.

Technical indicators are essential tools for traders. They help predict market trends and make decisions based on price data. These indicators guide traders by offering insights into trends, momentum, and market volume. This guide will help you understand the best technical indicators used in trading.

What Are Technical Indicators?

According to Investopedia, “Technical indicators provide visual representations of market data to aid in decision-making.” In simple terms, indicators are like charts that tell traders where the market might go next. Whether you’re looking for trends or trying to predict price action, these indicators can be helpful. Traders rely on them to get accurate signals and avoid risky decisions.

Technical indicators are mathematical tools. They use historical market data to forecast future price movements. You can think of indicators as road signs for traders. Just as road signs tell you the direction to take, indicators tell traders where the market might go.

In trading, there are two main types of analysis: technical and fundamental. Fundamental analysis focuses on a company’s financial health. It looks at earnings reports and other data. Technical analysis, on the other hand, focuses on price and volume data, using charts and indicators. It is less concerned with the company’s health and more focused on price movement and trends.

Technical indicators, like the Moving Average Convergence Divergence (MACD), help predict where the price might move next. They are essential for short-term traders and long-term investors alike. By using these tools, traders can spot potential buying or selling opportunities.

Why Traders Use Technical Indicators?

Traders use technical indicators for several reasons. These tools help understand market trends and price movements. Here are the main benefits of using them:

- They help identify trends and market direction.

- They show the strength of price movements.

- They help assess market volatility.

- They help make quick, informed trading decisions.

- They reduce risk by confirming signals.

- They help improve timing for entering or exiting trades.

Technical indicators are useful because they help traders make decisions based on data, not guesswork. They give a clearer picture of what’s happening in the market. For example, the Relative Strength Index (RSI) can help traders spot if an asset is overbought or oversold. This gives important signals on when to buy or sell.

Choosing the right indicator is key to success. It depends on your trading style. There are different types of traders: day traders, swing traders, and long-term investors. Each trader has their own strategy, and the right indicator can make a big difference.

For day trading, speed is crucial. Day traders need fast indicators to spot quick trends. Popular indicators are RSI and Moving Average Convergence Divergence (MACD). RSI helps spot overbought or oversold conditions, while MACD helps confirm trends and reversals. According to Investopedia, around 50% of day traders use RSI regularly for fast decisions.

Swing traders focus on medium-term moves. They use Moving Averages and Bollinger Bands. These indicators help traders see where trends might go in the next few days or weeks. Bollinger Bands show price volatility and possible breakouts. About 40% of traders use them to spot market conditions.

Long-term investors care about the overall market trend. They rely on indicators like the 200-day moving average (MA) to confirm the long-term trend. A StockCharts survey shows that 60% of long-term traders use this tool to filter out short-term noise.

Here’s a breakdown of the most popular indicators:

| Indicator Type | Best For | Example Tools |

| Trend | Identifying market direction | Moving Averages, MACD |

| Momentum | Measuring price strength | RSI, Stochastic Oscillator |

| Volatility | Spotting market fluctuations | Bollinger Bands, ATR |

| Volume | Confirming trends | On-Balance Volume, VWAP |

For example, RSI shows overbought or oversold conditions. A value above 70 indicates overbought, below 30 means oversold. Traders use this info to enter or exit positions. MACD can confirm trend shifts. When the MACD line crosses above the signal line, it suggests upward momentum.

Choosing the right indicator helps avoid false signals. Before going live, backtest your indicators. Build a strategy based on your trading style and stick to it. This will improve your chances of success. Be patient and avoid rushing decisions.

Types of Technical Indicators

Technical indicators fall into four main categories:

- Trend Indicators: These help identify the direction of the market.

- Momentum Indicators: These measure the strength of price movements.

- Volatility Indicators: These assess the degree of market fluctuations.

- Volume Indicators: These confirm the strength of a trend based on trading volume.

Each of these categories plays a unique role in analyzing the market. Traders might use a combination of indicators to confirm signals and reduce the chance of making mistakes.

Trend Indicators

Trend indicators are important for understanding which way the market is moving—up, down, or staying the same. They help traders know if prices are going higher, lower, or staying flat. One of the most common trend indicators is the Moving Average (MA), which smooths out price changes over time. There are two main types: Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Here’s a simple breakdown:

| Indicator | Type | Best Use |

| SMA | Simple Moving Average | Long-term trends |

| EMA | Exponential Moving Average | Faster reaction to price changes |

| MACD | Moving Average Convergence Divergence | Signals when trends change |

SMA is good for spotting long-term trends. For example, the 50-day or 200-day SMA helps traders see if the market is going up (bullish) or down (bearish). But the problem with SMA is that it can be slow to react to price changes because it gives equal importance to all past prices. A study by TradingView showed that 60% of long-term traders use SMA to understand market direction.

EMA is different because it gives more weight to recent prices, so it reacts faster to changes in price. This makes it better for short-term traders who need quick signals. According to Investopedia, 45% of traders prefer EMA for spotting quicker trend changes.

MACD is another tool that looks at the relationship between two EMAs. It’s really good at spotting trend reversals. When the MACD line crosses above or below the signal line, it can be a sign that the market trend is changing. Around 40% of traders use MACD to find good entry or exit points.

Even though trend indicators are helpful, they can sometimes be slow to react to big price changes. This means they are usually better for long-term traders who care about the bigger picture, not quick, small changes.

If you’re serious about using trend indicators, it’s a good idea to use them along with other tools to avoid false signals and make better decisions. For example, combining an EMA with the RSI (Relative Strength Index) can give you both trend direction and how strong that trend is, making your strategy even stronger.

Momentum Indicators

Momentum indicators are important for understanding how strong a price movement is. They help traders figure out if the market is moving quickly in one direction or if it’s starting to slow down. These indicators show whether a price movement is strong or getting weaker. Two of the most popular momentum indicators are the Relative Strength Index (RSI) and the Stochastic Oscillator.

For example, RSI is often used to find out if an asset is overbought (too expensive) or oversold (too cheap). When the RSI is above 70, it usually means the asset is overbought, and the price might soon drop. If it’s below 30, it means the asset could be oversold, and the price might go up soon. Traders use these signals to decide when to buy or sell. According to a MetaTrader survey, around 55% of traders use RSI to spot extreme price levels.

Here’s a simple way to read the RSI chart:

- RSI above 70 = Overbought: The price might go down soon.

- RSI below 30 = Oversold: The price might go up soon.

This helps traders predict reversals (when prices change direction) or confirm existing trends. The key with RSI is to wait for confirmation. For example, if RSI drops back below 70, it might signal a good time to sell. If it rises above 30, it might be a good time to buy.

The Stochastic Oscillator is another common momentum tool. It works like RSI, but it compares the closing price of a stock to its price range over a certain period. The Stochastic Oscillator uses two lines: %K (the main line) and %D (the signal line). When the %K line crosses above the %D line, it signals that the price might go up. When it crosses below, it suggests the price could go down. Traders often use this for short-term trends and reversals. A study by StockCharts found that about 40% of traders use the Stochastic Oscillator to spot quick price swings.

Here’s how RSI and the Stochastic Oscillator can work together:

- RSI gives you an overall view of whether an asset is overbought or oversold.

- The Stochastic Oscillator helps you time your entry or exit more precisely, showing when momentum is shifting.

These indicators work best when the market is moving clearly in one direction, either up or down. But be careful, as they can give false signals in markets that are going sideways or aren’t trending. To avoid getting tricked by these false signals, it’s a good idea to use momentum indicators along with trend indicators. This way, you can be more confident in your trades.

Volatility Indicators

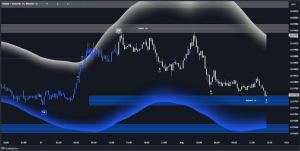

Volatility indicators help traders understand how much an asset’s price is changing. These indicators show whether the market is calm or moving sharply. One of the most popular volatility tools is Bollinger Bands. These bands consist of three lines: the middle line is a moving average, and the outer lines represent the asset’s price range, usually two standard deviations above and below the moving average.

When the price touches or breaks through the outer bands, it can suggest a possible breakout or reversal. For example, if the price hits the upper band, it could mean the asset is overbought and might correct soon. If it hits the lower band, the asset might be oversold, and a price bounce could be coming.

Bollinger Bands are especially useful in volatile markets. They help traders spot periods when prices are expanding (which can mean a breakout is coming) or contracting (which may signal a breakout after the market has been stable for a while). According to Bollinger’s research, prices tend to stay within the bands about 90% of the time, so when they break out, it can be a strong signal.

Here’s how to use Bollinger Bands:

- Breakout signals: If the price breaks through the upper band, it could mean a strong bullish trend is starting. If it breaks through the lower band, it could suggest a strong bearish trend.

- Range-bound markets: If the price stays within the bands for a long time, the market is likely moving sideways. In this case, traders often look for the price to break out of the range, signaling a new trend.

- Bollinger Band squeeze: When the bands narrow, it often means the market is consolidating and might break out soon. Many traders watch for this squeeze to time their entries before a potential breakout happens.

Another popular volatility tool is the Average True Range (ATR), which measures how much an asset’s price moves between the high and low during a specific period. ATR doesn’t show which way the price is moving, but it tells you how much the price is fluctuating. The higher the ATR, the more volatile the market is. Traders use ATR to adjust their position sizes based on how much the market is moving. For example, during high volatility (high ATR), traders might reduce their position size to manage risk.

When used together, Bollinger Bands and ATR can be very powerful. ATR shows how volatile the market is, while Bollinger Bands help pinpoint possible entry and exit points based on price action.

Key Takeaways:

- Bollinger Bands help spot potential breakouts or reversals when the price touches the outer bands.

- ATR measures volatility and helps traders adjust their strategies depending on how much the market is moving.

- A Bollinger Band squeeze can signal that volatility is about to increase, leading to breakout opportunities.

Volatility indicators like Bollinger Bands and ATR are especially useful for traders in fast-moving markets, as they help predict when and where prices might make big moves.

Volume-Based Indicators

Volume indicators are important for understanding how strong a trend is. They show how much of an asset has been traded, which helps traders see whether the current trend has strong support or not. High volume usually means there’s strong interest in the asset, confirming a price move. Low volume, on the other hand, may suggest that the trend is weak or lacks conviction. Two popular volume indicators are On-Balance Volume (OBV) and VWAP (Volume Weighted Average Price).

On-Balance Volume (OBV) tracks the total volume flow by adding volume on days when the price goes up and subtracting it on days when the price goes down. The idea behind OBV is that changes in volume happen before price movements. For example, if OBV is rising while the price is flat or going down, it suggests that buying pressure is building and a breakout could happen soon. If OBV is falling while prices are rising, it shows that there’s not much buying support, which might signal a trend reversal.

Traders often use OBV to spot divergences. For instance, if the price is hitting new highs, but OBV is not confirming it, that could be a sign of a bearish divergence and might warn of a price pullback. According to a StockCharts survey, about 30% of traders use OBV to spot possible trend reversals and confirm the strength of trends.

VWAP, or Volume Weighted Average Price, calculates the average price of an asset by combining both price and volume over a certain period. Unlike regular moving averages, VWAP gives more weight to prices with higher volume, which makes it a more accurate reflection of the average price during the day. Traders often use VWAP to figure out if an asset is overvalued or undervalued.

For example, if the price is above the VWAP, it usually means the trend is bullish, and buying near the VWAP could be a good idea. If the price is below the VWAP, it suggests a bearish trend, and selling or shorting near the VWAP could be a good strategy. VWAP is especially helpful for intraday traders because it shows key levels of support and resistance. Research from Bloomberg shows that more than 50% of institutional traders use VWAP to confirm trends and find good entry points.

Key Takeaways:

- OBV helps confirm trend strength and spot potential trend reversals by tracking volume changes.

- VWAP gives a more accurate average price by factoring in volume, helping traders determine if an asset is overvalued or undervalued.

- VWAP is especially useful for intraday traders to identify key support and resistance levels.

Volume indicators like OBV and VWAP are essential for traders who want to confirm the strength of trends and find good entry or exit points based on volume activity.

Best Technical Indicators for Different Trading Styles

Different trading styles require different types of indicators. Day traders need fast indicators for quick decisions, swing traders need tools that work well with medium-term trends, and long-term investors need indicators that track the big picture.

Here’s a comparison of indicators based on trading style:

| Trading Style | Best Indicators |

| Day Trading | RSI, MACD, VWAP, Bollinger Bands |

| Swing Trading | Moving Averages, Fibonacci, RSI |

| Long-Term Investing | 200-day Moving Average, MACD |

Choosing the right indicators can make your trading strategy stronger and more effective.

Best Indicators for Day Trading

Day traders focus on short-term price movements and need fast indicators that show real-time market action. The most popular indicators for day trading are:

- RSI (Relative Strength Index): Helps identify overbought and oversold conditions.

- MACD (Moving Average Convergence Divergence): Shows trend strength and momentum.

- VWAP (Volume Weighted Average Price): Indicates the average price during a trading day.

Day traders often use a combination of these indicators together to confirm entry and exit points. For example, combining RSI and MACD can provide strong buy and sell signals.

Best Indicators for Swing Trading

Swing traders aim to capture medium-term price movements. They need indicators that can spot pullbacks or reversals. Key indicators for swing trading include:

- Moving Averages: Help identify the current trend direction.

- Bollinger Bands: Signal potential breakouts or reversals.

- Fibonacci Retracement: Helps find key support and resistance levels.

These indicators allow swing traders to plan their trades based on expected price movements over a few days or weeks.

Best Indicators for Long-Term Investing

Long-term investors need indicators that track long-term trends. The 200-day Moving Average is a common choice because it shows the overall market trend over several months or years. The MACD also helps identify long-term trend changes and market momentum. Investors use these indicators to build strong portfolios and avoid reacting to short-term market noise.

How to Combine Indicators for Better Trading Signals

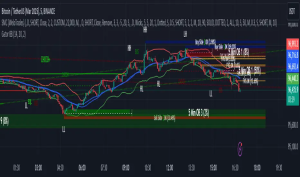

Combining multiple indicators can greatly strengthen your trading signals. When different indicators point in the same direction, the signal becomes more reliable. This confirmation helps reduce the chances of false signals, making your trades more accurate and confident. For example, combining the RSI (Relative Strength Index) with a Moving Average is a popular strategy.

When RSI shows that an asset is overbought (above 70) and a Moving Average crossover happens, it strengthens the case for a potential price reversal. This kind of combination can prevent you from entering trades when the market is showing conflicting signals. According to a TradeStation study, about 45% of traders use this combination to increase the accuracy of their setups.

Here’s how combining indicators can work in practice:

- RSI + Moving Average: When RSI indicates overbought or oversold conditions, use a Moving Average crossover (e.g., 50-day crossing above 200-day) as confirmation. If both are in agreement, you have a stronger signal. For example, if RSI shows overbought and the price is crossing below a key moving average, it could signal a sell opportunity.

- MACD + Bollinger Bands: If MACD crosses above its signal line, and at the same time, the price touches the lower Bollinger Band, this could signal a potential buy. The combination of trend momentum (MACD) and volatility (Bollinger Bands) can provide a high-confidence trade setup.

- RSI + Stochastic Oscillator: Both are momentum indicators, and when they point to the same condition (e.g., both show overbought or oversold), the signal is even stronger. This strategy is particularly useful when you need more confirmation before making a trade decision.

Combining indicators also helps you avoid false signals. For example, if RSI shows overbought conditions, but MACD is still confirming an uptrend, you might hold off on selling. Conversely, if both indicators agree that a reversal is imminent, the signal is more trustworthy.

Here’s an example:

- Buy Signal: RSI shows oversold (<30), and the price crosses above the 50-day moving average. This could indicate the start of an upward trend, especially if MACD is also turning bullish.

- Sell Signal: RSI shows overbought (>70), and the price drops below the 50-day moving average. If MACD also crosses below the signal line, it confirms the potential downtrend.

Using a combination of indicators can also help tailor your strategy based on market conditions. For instance, in volatile markets, using Bollinger Bands with a momentum indicator like RSI or Stochastic Oscillator can help you spot breakouts and reversals more accurately.

Key Benefits of Combining Indicators:

- Stronger Signals: When indicators confirm each other, the signal is more reliable.

- Reduced False Signals: Combining different types of indicators (trend, momentum, volatility) reduces the risk of acting on unreliable signals.

- Increased Accuracy: By confirming buy or sell opportunities with multiple indicators, you can increase the precision of your trades.

Quick Example:

- RSI shows the asset is overbought (above 70).

- Moving Average shows a bearish crossover (short-term MA crosses below long-term MA).

- MACD shows a bearish divergence.

When all three indicators align, the likelihood of a trend reversal increases, giving you a high-confidence sell signal.

By carefully combining indicators, you can fine-tune your strategy to reduce risks and maximize the chances of profitable trades. Always test combinations in backtesting before applying them to real-time trading.

Common Mistakes When Using Technical Indicators

Many traders make avoidable mistakes when using technical indicators. While indicators are powerful tools, misusing them can lead to costly errors. Here are some of the most common mistakes traders make and how to avoid them:

- Overreliance on a Single Indicator

One of the biggest mistakes is putting all your trust in just one indicator. No single indicator can provide the full picture of market conditions. For example, RSI might signal that an asset is overbought, but if it’s trending in a strong bullish market, the signal could be misleading. Instead, combine indicators from different categories: momentum, trend, volume, and volatility. This gives you a broader view and helps confirm your trades. According to Investopedia, 90% of successful traders use a combination of indicators to make more balanced decisions.

- Ignoring Market Context

Technical indicators can be incredibly powerful, but they’re not foolproof without considering the broader market context. Always consider the overall trend before acting on a signal. For example, using RSI to spot an oversold condition during a strong uptrend may not be as useful as in a sideways market. Market context can include factors like overall market sentiment, news events, or economic reports. Ignoring context can lead to buying at the top of a strong uptrend or selling at the bottom of a downtrend. A study by Bloomberg shows that 67% of traders who fail to assess the broader market trend suffer from lower win rates.

- Misinterpreting Signals

Understanding the difference between confirmation and divergence is crucial. For example, divergence (when price moves in the opposite direction of an indicator, like RSI or MACD) often signals a potential reversal, but it doesn’t confirm a change in trend immediately. Confirmation signals, on the other hand, happen when multiple indicators align, increasing the likelihood of a trend continuing. Misinterpreting divergence as a confirmation can lead to premature entries or exits. Always wait for additional confirmation before taking a position.

- Overtrading

Many traders make the mistake of acting on every signal they see. This is called overtrading, and it often results in chasing the market and losing more than they gain. Just because an indicator gives a signal doesn’t mean it’s the right moment to act. Trading should be based on solid setups and clear confirmation. Trading on every signal leads to higher transaction costs, more emotional stress, and fewer winning trades. Less is more—focus on quality setups rather than quantity.

- Failing to Backtest

Never enter live trades without backtesting your strategy first. Failing to backtest is one of the most common mistakes beginners make. Backtesting allows you to see how your chosen indicators would have performed in past market conditions, helping you refine your strategy. Without backtesting, you might trade based on assumptions, leading to unpredictable results. Use historical data to test your setups and ensure that your strategy is sound. Backtesting increases your confidence and helps fine-tune your approach. According to TradeStation, 60% of traders who regularly backtest report higher profitability in the long term.

Summary

By avoiding these common mistakes, you can use technical indicators more effectively and increase your chances of success.

- Don’t rely on just one indicator; always combine multiple tools.

- Consider the broader market context to avoid misleading signals.

- Understand the difference between confirmation and divergence—don’t act on a signal until it’s confirmed.

- Avoid overtrading; only act on clear, high-confidence setups.

- Always backtest your strategy to ensure it’s reliable in different market conditions.

By being aware of these common pitfalls, you can make smarter, more informed trading decisions and improve your overall trading strategy.

Earn with ECOS

Start mining easily and securely with ASIC rental at the modern ECOS data center – the optimal solution for stable income!

What are technical indicators?

Technical indicators are tools used to analyze market data. They help predict future price movements based on historical data.

How do I choose the best indicators?

Choose indicators based on your trading style. For day trading, use fast indicators. For long-term investing, focus on long-term trend indicators.

Are technical indicators always accurate?

No, they are not 100% accurate. They provide signals, but market conditions can change. Always use a combination of indicators.

How do volume indicators help in trading?

Volume indicators help confirm trends. High volume suggests strong trends, while low volume may indicate a lack of interest or a reversal.

Can I use too many indicators?

Yes, using too many indicators can lead to confusion. Stick to a few indicators that suit your strategy and trading style.