Is Bitcoin a Good Investment For Beginners?

Key Takeaways

-

Bitcoin’s halving event in April 2024 could trigger long-term price growth.

-

After past halvings, Bitcoin’s price climbed gradually over months, not instantly.

-

The market is unpredictable. Prices can swing wildly in a short time.

-

Major investors like Michael Saylor and Elon Musk continue to support Bitcoin.

-

Spot Bitcoin ETFs approved in 2024 are attracting institutional investors.

-

Regulations remain a wildcard. Government policies could impact Bitcoin’s future.

What is Bitcoin, and Why is it Popular?

Bitcoin is a digital currency that operates on a decentralized network. Unlike traditional money, it’s not controlled by banks or governments. Instead, Bitcoin transactions are verified by thousands of computers worldwide. This makes it resistant to censorship and inflation.

People are drawn to Bitcoin for different reasons. Some see it as digital gold — a scarce asset that could increase in value over time. Others use it for fast, borderless payments. In countries with unstable currencies, Bitcoin offers a way to store wealth without relying on banks. Businesses and institutions are also adopting Bitcoin, seeing it as a hedge against economic uncertainty.

Bitcoin is popular, but it’s still evolving. It has the potential to reshape finance, but it also faces challenges like regulatory uncertainty, environmental concerns, and security risks.

Bitcoin Halving 2024: Less Supply, More Hype?

In April 2024, Bitcoin underwent its fourth halving. This event reduced block rewards from 6.25 to 3.125 BTC. Historically, halvings decreased Bitcoin’s supply rate. This scarcity often led to price surges. For instance, post-2012 halving, Bitcoin soared from $12 to $1,000. Similarly, after the 2016 halving, prices escalated. By March 2025, Bitcoin’s price dynamics remain influenced by the 2024 halving. Investors anticipate potential bullish trends. However, market conditions and external factors also play pivotal roles. Thus, while halving impacts supply, other elements shape Bitcoin’s price trajectory.

The Benefits and Risks of Investing in Bitcoin

Bitcoin is one of the most exciting and controversial investments of the 21st century. It has made some investors millions, but it has also wiped out fortunes overnight. Let’s break down the pros and cons.

Bitcoin Investment Pros

- High potential for long-term growth. Over the past decade, Bitcoin has outperformed traditional investments like stocks, gold, and real estate. Some analysts predict it could reach $150,000+ by the end of 2025 if adoption continues.

- Fixed supply. Only 21 million BTC will ever exist. Unlike dollars or euros, which governments print endlessly, Bitcoin’s scarcity makes it resistant to inflation and a hedge against economic instability.

- Borderless transactions. Send Bitcoin anywhere, anytime without banks, restrictions, or excessive fees. In countries with weak financial systems, Bitcoin provides financial freedom like never before.

- Growing institutional adoption. Hedge funds, Fortune 500 companies, and even countries are adding Bitcoin to their balance sheets. The launch of Bitcoin ETFs has made it even easier for big money to flow in.

- Open and decentralized. No single government, bank, or corporation controls Bitcoin. No one can freeze your funds or block your transactions. This makes it one of the most independent financial assets ever created.

Bitcoin Investment Cons

- Extreme price volatility. Bitcoin is not for the weak-hearted. Its price can skyrocket 200% in a year or crash 50% in weeks. If you panic-sell during dips, you will lose money.

- Security risks. If your wallet is hacked, or you lose your private key, your Bitcoin is gone forever. Unlike banks, there is no customer support to recover lost funds.

- No consumer protection. Send Bitcoin to the wrong address? Stolen funds? Too bad. Unlike traditional banks, there is no way to reverse a mistaken transaction.

- Uncertain regulations. Some governments embrace Bitcoin, while others ban or heavily tax it. New laws could impact how Bitcoin is traded, owned, or even mined.

- High energy consumption. Bitcoin mining consumes more electricity than some countries. This has raised environmental concerns, though new advancements like renewable energy mining are helping reduce the impact.

Bitcoin vs. Traditional Investments: What’s Better for Beginners?

Investing is all about balancing risk and reward. Some assets are stable but offer slow growth. Others are risky but can deliver massive returns. Let’s break it down.

| Feature | Bitcoin | Stocks | Gold | Bonds |

| Volatility | High | Medium | Low | Low |

| Inflation Hedge | Strong | Limited | Strong | Weak |

| Long-Term Growth | High | High | Slow | Low |

| Dividends/Interest | No | Yes | No | Yes |

| Accessibility | 24/7 Trading | Market Hours | Physical & Digital | Requires Broker |

Which One is Better?

- Bitcoin is high risk. High reward. It has outperformed every traditional asset over the past decade, but it also experiences wild price swings.

Stocks offer steady growth with dividends. They are less risky than Bitcoin but still require knowledge of the market.

Gold is a safe-haven asset. It doesn’t crash like Bitcoin, but it also grows much slower. Investors use it to protect their wealth rather than grow it quickly.

Bonds are the safest but offer the lowest returns. They provide stability and guaranteed income but won’t make you rich.

What’s Best for Beginners?

A balanced approach. Don’t go all-in on Bitcoin. Diversify your investments across multiple asset classes to manage risk.

A simple beginner-friendly strategy.

- 50% stocks for steady long-term growth.

- 20% Bitcoin for high-risk, high-reward potential.

- 20% bonds for stability.

- 10% gold as an inflation hedge.

This way, you maximize potential gains while protecting yourself from major losses. Investing isn’t about betting on one asset. It’s about building a smart portfolio.

How to Buy Bitcoin: A Step-by-Step Guide

Buying Bitcoin is easier than ever in 2025. But doing it safely and smartly is what really matters. Follow these steps to get started.

1. Choose a Crypto Exchange

Pick a reputable crypto exchange that suits your needs. Some of the top platforms include.

- Binance. Best for low fees and advanced traders.

- Coinbase. User-friendly. Great for beginners.

- Kraken. Strong security and staking options.

- OKX & ECOS. Good for buying Bitcoin and exploring mining options.

Each exchange has different fees, features, and security measures. Compare before signing up.

2. Create an Account and Verify Identity

Most exchanges require KYC (Know Your Customer) verification. Be ready to upload an ID (passport or driver’s license) and a selfie. This prevents fraud and complies with regulations.

3. Deposit Funds

You can fund your account in multiple ways.

- Bank transfer. Cheaper, but slower.

- Credit/debit card. Instant, but higher fees.

- PayPal or Apple Pay. Depends on exchange.

- Another cryptocurrency. If you already own crypto, you can trade it for Bitcoin.

Each method has its pros and cons. Check fees and processing times before depositing.

4. Buy Bitcoin

Once your funds are in, you can purchase Bitcoin using.

- Market Order. Instantly buys Bitcoin at the current price.

- Limit Order. Lets you set a price. The order executes when Bitcoin hits that price.

For beginners, a market order is the easiest way to buy. But if you want better control over the price, use a limit order.

5. Store Bitcoin Securely

After buying Bitcoin, don’t leave it on an exchange. Especially if you plan to hold it long-term. Move it to a secure wallet.

- Hot Wallets (Software). Apps like MetaMask, Trust Wallet, or Coinbase Wallet for easy access.

- Cold Wallets (Hardware). Ledger or Trezor devices for maximum security.

If you lose access to your private key or wallet, your Bitcoin is gone forever. Store backups safely.

Bitcoin Market Trends and Future Predictions

Bitcoin’s price has experienced significant fluctuations in recent months. After reaching an all-time high of over $109,000 in January 2025, it has since declined to approximately $84,720 as of March 1, 2025.

Factors Influencing Bitcoin’s Price:

Potential Drivers for Price Increase:

- Institutional Adoption: The approval of Bitcoin ETFs in the U.S. has made it easier for institutional investors to gain exposure to Bitcoin, potentially increasing demand.

- Fixed Supply: Bitcoin’s supply is capped at 21 million coins, creating scarcity that could drive up prices as demand increases.

- Global Adoption: More businesses and even some governments are considering integrating Bitcoin into their financial systems, enhancing its legitimacy and use cases.

Potential Causes for Price Decrease:

- Regulatory Changes: Uncertainty or unfavorable regulations from governments worldwide can negatively impact Bitcoin’s price.

- Market Corrections: Broader economic downturns or corrections in financial markets can lead to reduced investment in cryptocurrencies.

- Technological Risks: Security vulnerabilities or advancements in technology, such as quantum computing, could pose threats to Bitcoin’s infrastructure.

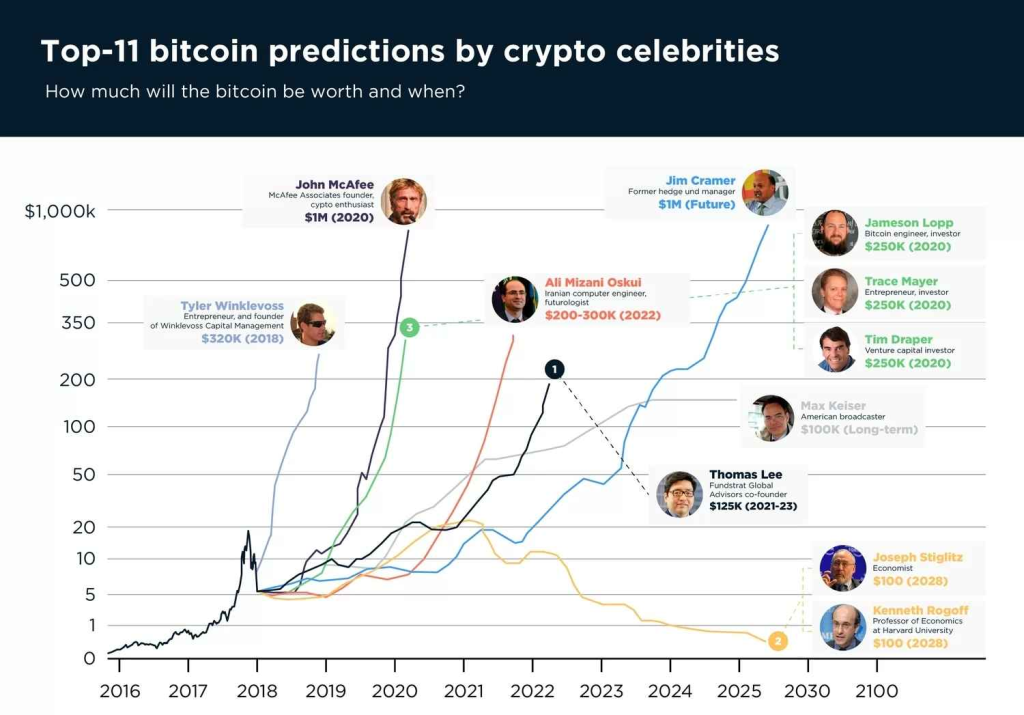

What do crypto celebrities think about Bitcoin’s future prices?

Investors should remain cautious and stay informed about the various factors that can influence Bitcoin’s volatile market.

Final Thoughts: Is Bitcoin a Good Investment for Beginners?

Bitcoin is a high-risk, high-reward asset. Some early investors became millionaires. Others lost fortunes in brutal crashes.

If you’re new to investing, Bitcoin can be a great opportunity — but only if you approach it wisely. Start small. Think long-term. Educate yourself. And most importantly, never invest money you can’t afford to lose.

Bitcoin’s future looks bright, with growing institutional adoption and increasing scarcity. But volatility will always be part of the game. Smart investors stay patient, diversified, and ready for anything.

If you’re ready to take the next step into Bitcoin and crypto mining, now is the time to explore your options.

Start mining Bitcoin with ECOS! We offer flexible partnership options, including profitable cloud mining and equipment rental. This way, you can start smoothly and scale up as you grow.

Is Bitcoin a good investment?

Yes, if you can handle extreme volatility. No, if you want easy money. Bitcoin can make you rich or broke. It’s not passive income. Only invest if you understand the risks.

How much should beginners invest?

Invest what you can afford to lose. Don’t use rent money. Many start with $50-$100. Use DCA (dollar-cost averaging) to reduce risk. Don’t try to time the market.

What are Bitcoin’s biggest risks?

Prices crash fast, sometimes in hours. Scammers and hackers are everywhere. Governments could restrict Bitcoin anytime. Lose your private keys? Your money is gone forever.

Will Bitcoin keep going up?

Nobody knows for sure. Supply is limited to 21 million. Demand is growing, but regulations could hurt prices. Some predict $100K+, others say it’s a bubble.

How to store Bitcoin safely?

Use a hardware wallet like Ledger or Trezor. If using an exchange, enable 2FA. Never share private keys. Lose access? No one can recover your Bitcoin.