Bitcoin Cash (BCH): A Comprehensive Guide to How It Works, Benefits, and Future Prospects

Key Takeaways

-

Bitcoin Cash enables fast, low-cost transactions using blockchain technology.

-

Larger block sizes (32MB) allow for more transactions per second.

-

BCH supports peer-to-peer transactions without banks or intermediaries.

-

The network remains secure and decentralized, relying on proof-of-work mining.

-

BCH is ideal for daily transactions, trading, and investing in Bitcoin Cash.

Bitcoin Cash (BCH) is a decentralized digital currency designed for fast, low-cost peer-to-peer transactions. Created in 2017 through a Bitcoin hard fork, it solves the scalability issues of Bitcoin (BTC) by offering larger block sizes and significantly lower fees.

With an increasing number of businesses accepting crypto payments, BCH is becoming a practical alternative to traditional banking and even other cryptocurrencies. Whether you’re interested in BCH trading strategies, Bitcoin Cash mining, or just want to store Bitcoin Cash securely, this guide will cover everything you need to know.

What is Bitcoin Cash (BCH)?

Bitcoin Cash (BCH) is a decentralized cryptocurrency that emerged from a hard fork of Bitcoin in August 2017. The split happened because of long-standing disagreements over Bitcoin’s scalability. Bitcoin’s 1MB block size was causing network congestion, slow transaction speeds, and rising fees. This made BTC impractical for everyday transactions.

To solve these issues, Bitcoin Cash increased the block size to 32MB, allowing for faster transactions and significantly lower costs. Unlike Bitcoin, often referred to as “digital gold” because of its store-of-value nature, Bitcoin Cash is positioned as “digital cash” — a fast, efficient, and cheap alternative for daily payments.

Why Bitcoin Cash Matters in 2025

Bitcoin Cash has grown into one of the most widely used cryptocurrencies for payments. Here’s why:

1. Scalability

Bitcoin Cash can handle up to 200 transactions per second (TPS), compared to Bitcoin’s 7 TPS. This makes it more practical for daily use and mass adoption.

2. Low Fees

BCH transactions typically cost less than $0.01, regardless of the amount sent. In contrast, Bitcoin transaction fees can fluctuate between $1 to $50, depending on network congestion. This makes BCH ideal for microtransactions, online shopping, and cross-border payments.

3. Fast Confirmations

While Bitcoin transactions can take 10 minutes to hours, Bitcoin Cash transactions are confirmed within seconds, making it a better choice for merchants and everyday users.

4. Decentralized and Permissionless

No government, bank, or single entity controls Bitcoin Cash. Anyone can use it freely without restrictions, making it a powerful tool for financial sovereignty.

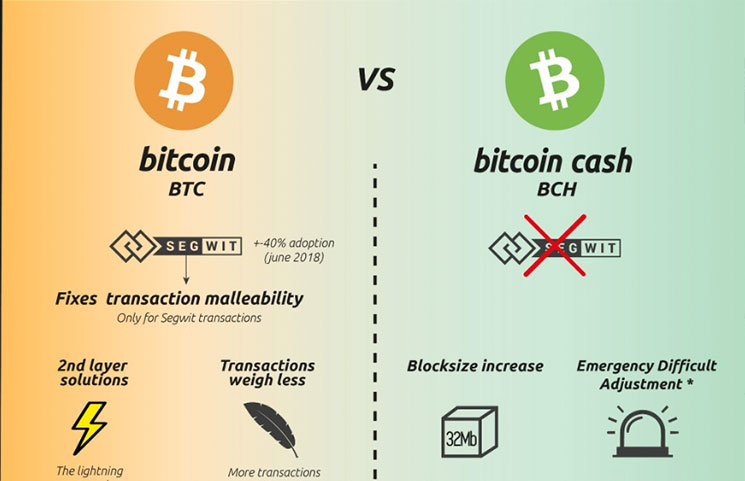

Bitcoin Cash vs. Bitcoin: What’s the Difference?

Bitcoin (BTC) and Bitcoin Cash (BCH) started from the same place but took different paths. One is a slow, secure giant. The other is fast, cheap, and built for spending. Which one is right for you?

The Core Differences

| Feature | Bitcoin (BTC) | Bitcoin Cash (BCH) |

| Block Size | 1MB | 32MB |

| Transaction Speed | 10+ minutes | A few seconds |

| Fees | $5 – $10 | <$0.01 |

| Use Case | Store of Value | Fast Payments |

| Scalability | Limited | High |

BTC vs. BCH: Which One Should You Use?

-

Bitcoin (BTC) = Digital Gold

BTC is slow, expensive, and secure. That’s not a flaw — it’s a feature. Investors treat it like gold, a long-term store of value. Institutions, hedge funds, and even governments hold BTC as an inflation hedge. -

Bitcoin Cash (BCH) = Digital Cash

BCH was designed to be used, not just held. Low fees and fast transactions make it perfect for everyday purchases, remittances, and business payments.

Real-World Examples

BTC in Action:

- In 2021, El Salvador made BTC legal tender. But daily use was tough — high fees made small transactions impractical.

- Most people still hold BTC instead of spending it.

BCH in Action:

- Merchants like Newegg, CheapAir, and hundreds of small businesses accept BCH.

- In regions with unstable economies, like Venezuela and Nigeria, BCH adoption is growing due to its low fees.

Interesting Finds

- The BTC network can handle about 7 transactions per second. Compare that to Visa, which does 24,000+ TPS.

- BCH increased its block size to 32MB, meaning it can process way more transactions — over 100 TPS.

- BTC fees once spiked to $60+ per transaction during peak congestion. BCH fees remain below a penny.

- BTC has the highest market cap (over $1 trillion), but BCH remains one of the top 30 cryptocurrencies.

The Big Question: BTC or BCH?

Choose BTC if:

✅ You’re looking for a long-term store of value.

✅ Security and decentralization matter more than speed.

✅ You believe BTC will keep rising in price.

Choose BCH if:

✅ You want to send money with near-zero fees.

✅ You need fast, reliable transactions for daily spending.

✅ You believe in a future where crypto replaces cash.

The Final Verdict

BTC is king for hodlers. BCH is built for spending. It’s not about which is better — it’s about what you need. Choose wisely.

How Does Bitcoin Cash Work?

Bitcoin Cash (BCH) runs on blockchain technology — a decentralized, transparent ledger that records every transaction. No banks. No middlemen. Just fast, low-cost peer-to-peer transfers.

How transactions work:

- User A sends BCH to User B’s wallet.

- The transaction is broadcasted to the Bitcoin Cash network.

- Miners validate the transaction using proof-of-work (PoW).

- The transaction is added to a new block on the blockchain.

- Confirmation happens in seconds, and User B receives the funds.

Unlike Bitcoin (BTC), which can take 10+ minutes for confirmation, BCH transactions are nearly instant. That makes BCH ideal for real-world payments.

Security & Decentralization

Bitcoin Cash is built on the same proof-of-work security model as Bitcoin, ensuring network integrity and preventing fraud. Here’s why BCH is secure:

- Immutable Ledger: Once a transaction is recorded on the blockchain, it cannot be altered or reversed. No chargebacks. No double spending.

- Decentralized Miners: Thousands of miners worldwide validate transactions, ensuring no single entity controls the network.

- 51% Attack Resistance: While less secure than BTC (due to lower hash power), BCH still relies on robust mining security.

Advantages and Features of Bitcoin Cash

Bitcoin Cash (BCH) stands out in the crypto world with its focus on speed, low fees, and scalability. Unlike Bitcoin (BTC), which has become more of a store of value, BCH is designed for daily transactions — fast, cheap, and decentralized.

- Large Block Size (32MB)

- High Transaction Throughput: BCH supports hundreds of transactions per second, compared to Bitcoin’s 7 TPS limit.

- No Network Congestion: BTC often experiences delays during peak times, leading to skyrocketing fees. BCH avoids this problem by processing more transactions per block.

- Lower Costs for Everyone: Bigger blocks prevent backlogs, keeping fees consistently low.

- Low Transaction Fees

- Near-Zero Fees: The average BCH transaction fee is less than $0.01, making it ideal for small payments, microtransactions, and international remittances.

- BTC vs. BCH: Bitcoin fees can range from $5 to $50+ during high network activity. BCH keeps transactions affordable regardless of demand.

- Merchant-Friendly: Businesses accepting BCH don’t have to worry about excessive fees eating into their profits.

- Peer-to-Peer Transactions

- No Banks, No Middlemen: BCH lets users send money directly to anyone, anywhere, without relying on banks or payment processors.

- Global Accessibility: Traditional banking can be slow and expensive, especially for cross-border payments. BCH provides a fast, permissionless alternative.

- Ideal for Businesses: Companies can accept BCH as payment without needing third-party payment gateways, avoiding extra fees and chargebacks.

- Secure and Decentralized Network

- Proof-of-Work Security: BCH uses the same mining algorithm as Bitcoin, ensuring a high level of security against attacks.

- Censorship-Resistant: No government or financial institution can freeze or block BCH transactions. It remains open and permissionless for everyone.

- Distributed Mining Power: A network of miners worldwide verifies transactions, preventing control by a single entity.

How to Buy and Store Bitcoin Cash Securely

Buying and storing Bitcoin Cash (BCH) securely helps protect your investment from hacks, scams, and theft. Here’s how to do it the right way.

How to Buy BCH

Bitcoin Cash (BCH) is a popular cryptocurrency known for its low transaction fees and fast processing times. If you’re looking to buy BCH, follow these steps to ensure a smooth and secure purchasing process.

- Choose a Crypto Exchange

The first step in buying BCH is selecting a cryptocurrency exchange that supports it. When choosing an exchange, consider factors such as security, fees, ease of use, and supported payment methods. Here are some of the top exchanges for buying BCH:

- Binance – One of the largest and most popular cryptocurrency exchanges, Binance offers high liquidity, competitive fees, and advanced trading tools. It is ideal for both beginners and experienced traders.

- Kraken – Known for its strong security measures and user-friendly interface, Kraken provides fiat deposit options, making it easy for users to buy BCH with traditional currencies.

- Coinbase – A great choice for beginners, Coinbase allows users to purchase BCH using credit and debit cards, making the buying process quick and straightforward.

Each exchange has its own advantages, so choose the one that best fits your needs.

- Create and Verify Your Account

Once you’ve selected an exchange, you’ll need to create an account and complete the identity verification process. This step is required to comply with Know Your Customer (KYC) regulations and to ensure security.

- Sign up – Provide your email address and create a strong password to register on the exchange.

- Complete KYC verification – Most exchanges require users to verify their identity by submitting government-issued identification, proof of address (such as a utility bill or bank statement), and in some cases, a selfie to confirm authenticity.

- Enable security features – To protect your funds, set up two-factor authentication (2FA) and use a strong password to secure your account.

Account verification can take anywhere from a few minutes to a few days, depending on the exchange’s policies and processing speed.

- Deposit Funds

Before purchasing BCH, you need to deposit funds into your exchange account. Most exchanges offer several funding options:

- Bank transfer – Depositing funds via a bank transfer is a cost-effective method, as it usually comes with lower fees. However, it may take a few days for the transaction to be processed.

- Credit or debit card – This option allows you to buy BCH instantly, but it usually comes with higher transaction fees compared to bank transfers.

- Crypto deposit – If you already own another cryptocurrency, you can transfer it to your exchange account and trade it for BCH. This is a convenient option for those who want to avoid fiat transactions.

Be sure to check the deposit limits and processing times for each method before proceeding.

- Buy Bitcoin Cash (BCH)

Once your account is funded, you can proceed with purchasing BCH. Follow these steps to complete your transaction:

- Select a BCH trading pair – On the exchange, search for BCH trading pairs such as BCH/USD, BCH/USDT, or BCH/BTC. Choose the pair that matches your preferred funding method.

-

Choose an order type:

- Market order – Instantly buy BCH at the current market price. This is the fastest way to purchase BCH, but prices may fluctuate.

- Limit order – Set a specific price at which you want to buy BCH. The order will be executed only when the market price reaches your specified level. This option provides more control over pricing.

- Confirm the transaction – Once you’ve selected your order type, enter the amount of BCH you want to buy and review the details before confirming the purchase.

After completing the transaction, it is highly recommended to transfer your BCH to a secure crypto wallet instead of leaving it on the exchange. This ensures better security, as exchanges can be vulnerable to hacking.

By following these steps, you can successfully purchase Bitcoin Cash and take advantage of its benefits as a fast and efficient digital currency. Always remember to conduct thorough research and use security best practices when dealing with cryptocurrencies.

How to Store Bitcoin Cash Securely

Properly storing your Bitcoin Cash (BCH) is essential to protect it from online threats, hacking attempts, and unauthorized access. There are several storage methods, each with its advantages and disadvantages. Choosing the right option depends on how frequently you plan to use your BCH and the level of security you require.

Software Wallets (Hot Wallets) – Best for Convenience

Software wallets, also known as hot wallets, are digital wallets that are connected to the internet. They are suitable for users who frequently make transactions and need quick access to their BCH.

- Mobile and desktop apps allow users to send, receive, and manage BCH easily.

- Popular software wallets include Trust Wallet, Exodus, and the Bitcoin.com Wallet.

Pros:

- Easy to use and set up

- Free and widely accessible

- Ideal for everyday transactions

Cons:

- Vulnerable to hacking and malware attacks if not properly secured

- Dependence on internet connectivity increases risk exposure

To enhance security, always enable two-factor authentication (2FA) and keep your software wallet updated with the latest security patches.

Hardware Wallets (Cold Storage) – Best for Security

Hardware wallets store your BCH offline, making them one of the safest options for long-term storage. These physical devices are designed to keep your private keys isolated from internet-based threats.

- Offline storage ensures protection from hackers and phishing scams.

- Recommended hardware wallets include Ledger Nano S, Ledger Nano X, and Trezor Model T.

Pros:

- Extremely secure, as private keys never connect to the internet

- Best option for long-term storage of large amounts of BCH

- Resistant to malware and hacking attempts

Cons:

- Requires an initial investment, typically ranging from $50 to $150

- Less convenient for frequent transactions

If you choose a hardware wallet, store it in a safe location and keep a backup of your recovery phrase in case the device is lost or damaged.

Paper Wallets – Best for Maximum Protection

A paper wallet is an offline method of storing BCH by printing private and public keys on a physical document. Since it is entirely disconnected from the internet, it eliminates the risk of cyberattacks.

- Private keys are stored on paper, keeping them completely offline.

Pros:

- No risk of online hacks or malware attacks

- Highly secure if stored properly

Cons:

- Can be easily lost, stolen, or damaged

- No recovery option if misplaced or destroyed

To use a paper wallet safely, store it in a fireproof safe or a secure deposit box, and consider making multiple copies in case of loss or damage.

Additional Security Tips

Regardless of the storage method you choose, following these security practices will help keep your BCH safe:

- Enable Two-Factor Authentication (2FA) – Adds an extra layer of security to exchanges and wallets.

- Avoid Keeping Large Amounts on Exchanges – Exchanges can be hacked or freeze accounts without notice. Store your BCH in a private wallet instead.

- Backup Your Private Keys – Keep copies in secure, offline locations such as a fireproof safe or encrypted USB drive.

- Watch Out for Phishing Scams – Always verify website URLs before entering login details to avoid falling victim to fake websites.

Which Storage Option Should You Choose?

- For everyday transactions: A software wallet like Trust Wallet or Exodus is ideal for convenience and quick access.

- For long-term storage: A hardware wallet like Ledger or Trezor provides top-tier security while remaining easy to use.

- For ultimate security: A paper wallet ensures complete offline protection but requires careful handling to avoid loss or damage.

Bitcoin Cash Mining

Bitcoin Cash (BCH) mining involves using specialized hardware to validate transactions, secure the network, and earn BCH rewards. Miners solve complex mathematical problems, and in return, they receive newly minted BCH and transaction fees.

Mining BCH vs. BTC

While Bitcoin (BTC) and Bitcoin Cash (BCH) share the same SHA-256 mining algorithm, they differ in several ways. BCH has a larger block size (32MB vs. 1MB for BTC), allowing for more transactions per block. Both networks adjust mining difficulty every 2016 blocks, but BCH mining tends to be more stable in profitability, as BTC’s competition makes it harder for smaller miners. The block reward for mining BCH is currently 6.25 BCH per block, the same as BTC.

How to Start Mining BCH

To mine Bitcoin Cash, you need specialized hardware known as ASIC miners, such as the Antminer S19 or WhatsMiner M30S, which are optimized for SHA-256 mining. Given the high mining difficulty, joining a mining pool like ViaBTC, BTC.com, or Antpool is recommended to increase your chances of earning rewards.

After acquiring the hardware, install mining software like CGMiner or BFGMiner, configure it to connect to your chosen mining pool, and start mining. Rewards are distributed based on your contribution (hash rate) within the pool.

Profitability Considerations

Mining BCH can be profitable but requires a significant initial investment in hardware and electricity. ASIC miners range from $1,000 to $10,000, and mining profitability depends on factors like electricity costs, market prices, and mining difficulty. It is advisable to use a mining profitability calculator before investing to estimate potential earnings based on your location’s electricity rates.

Bitcoin Cash mining can generate passive income, but careful cost analysis and a stable electricity source are essential for long-term profitability. Beginners should start with a mining pool rather than solo mining for more consistent rewards.

The Future of Bitcoin Cash: Predictions and Trends

Bitcoin Cash (BCH) continues to gain traction as a fast and low-cost payment solution, with more businesses integrating it into their payment systems. As the cryptocurrency landscape evolves, BCH is expected to see both growth opportunities and challenges in the coming years.

Future Developments

One of the key drivers of BCH’s future success is its increasing adoption by merchants and e-commerce platforms. As more businesses accept BCH for payments, its utility as a digital currency will expand, making it a viable alternative to traditional payment methods.

At the same time, ongoing blockchain upgrades will further improve transaction speeds and scalability, reinforcing BCH’s position as a cost-effective solution for peer-to-peer transactions. Developers are also exploring smart contract capabilities, which could enable BCH to support decentralized applications (DApps) and compete with blockchains that offer more than just payments.

Potential Challenges

Despite its strengths, BCH faces competition from major blockchains like Ethereum, Solana, and Binance Smart Chain, which already have established ecosystems for smart contracts and decentralized finance (DeFi). For BCH to compete effectively, it will need to innovate beyond being just a payment-focused cryptocurrency.

Another challenge is regulatory uncertainty, as governments worldwide continue to refine their stance on cryptocurrency payments and transactions. Stricter regulations on digital assets could impact BCH adoption, especially for merchants and payment processors.

Outlook for Bitcoin Cash

While competition and regulations pose challenges, BCH remains an exciting investment opportunity due to its strong fundamentals as a fast and efficient payment system. If adoption continues to grow and the network successfully integrates smart contract functionality, BCH could see increased relevance in the broader crypto ecosystem.

Earn with ECOS mining! Start with low investment, enjoy passive income, and scale your profits over time.

What is Bitcoin Cash and how does it differ from Bitcoin?

Bitcoin Cash is a hard fork of Bitcoin focused on fast and low-cost transactions.

What are the benefits of using Bitcoin Cash?

- Faster transactions

- Lower fees

- Decentralized network

- Scalable blockchain technology

How can I buy and store Bitcoin Cash safely?

Use a reputable exchange and store Bitcoin Cash securely in a hardware wallet.

Is Bitcoin Cash a good investment?

It has strong scalability and adoption, making it a potential long-term investment.

Will Bitcoin Cash grow in value in the future?

As adoption increases, BCH could see significant price appreciation.